THE last quarter for which we have national statistics for the rate at which rents fluctuate in the 26 counties is Q4 of 2019. Daft.ie’s reports issued four times annually are met with interest, given the enormous database from which it collates statistics.

This portal to residential (and commercial) rentals and sales is used by virtually all estate agents and by private landlords who eschew an agency to let and maintain properties.

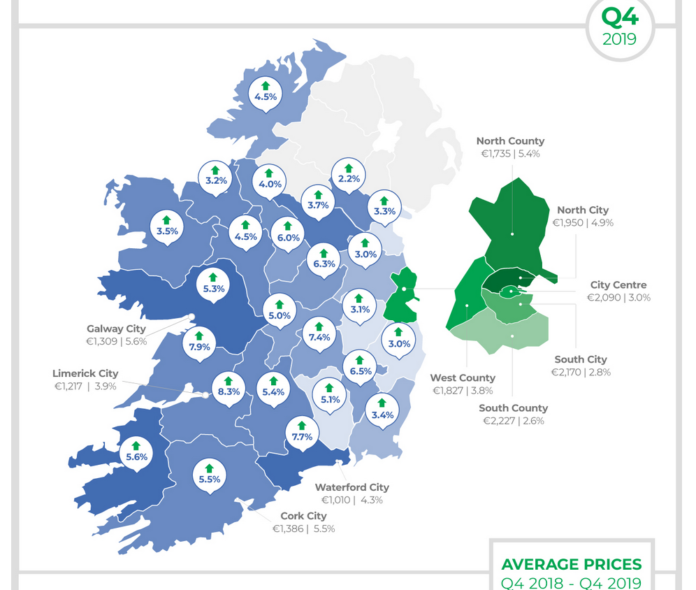

Note the Daft infographic that shows the biggest increase in rents charged in the country were in Limerick. This is true of the city especially, presenting an 8.3 per cent gain over Q4 2018. Properties in adjacent Clare were charging almost 8 per cent more than in the last quarter of 2018.

The FG-FF coalition is deemed to have fallen on the twin spears of Housing and Health. Swathes of the electorate who voted were unmoved by a 95 per cent employment rate, years of slog for a stable Brexit and Ireland ranked by the UN in December as 3rd best country in the world for quality of life (pipped by Switzerland and Norway, tops).

What is driving rents here up, vis a vis Dublin levelling off with household income maxed out in The Pale?

Scarcity. Daft.ie’s analyst Prof Ronan Lyon of TCD makes the point that construction costs for apartments “make it unviable to build the thousands of new rental homes that are desperately needed.”

Another factor is the thousands of private landlords bailing out of the sector due to steep taxes and the cost of refurbishment between tenancy turnovers.

2019 closing data for rents:

€1,402 national average

€896 Limerick county

€1,167 Limerick city

( €667 average mortgage)

Feb 2020 – 76 properties available

With a burgeoning jobs market in the Mid-Wests biopharma, food, finance, tech and aviation sectors, there has been a major influx in professional workers and their families moving to Limerick. From Cook Medical to WP Engine, Johnson & Johnson to Regeneron, recruitment campaigns by locally rooted industry are bringing an educated populace to the Mid-West.

For sure, new residential stock is coming on board in the suburbs, in city new builds and the remodelling of older properties. But in a market of rising residential values, owners of landbanks and builders know that their assets are appreciating all the time. Limerick City and County Council is backing a €12mn investment in public housing so future supply is being addressed.

The good news is that available rental accommodation nationally has increased by 10 per cent in 2020 since last year. Much of this is driven by tax-friendly house sharing in a landlord’s principal private residence, such contracts being outside the remit of the Rental Tenancies Board.

The most recent rental index for the Board is Q3 of 2019. The Irish Property Owners Association (IPOA) had a big reaction to news that there were 21,235 tenancies registered in Q3 2019 compared to 25,448 in Q3 2018.

“There was a drop of 17 per cent in the amount of tenancies registered,” commented Stephen Faughnan of the IPOA. “Rent Pressure Zones limit the income of investors without limiting the cost of the provision of the accommodation. Property owners who rewarded good tenants by keeping the rent low have been unfairly and substantially disadvantaged.

“A recent survey carried out by IPOA revealed that 31 per cent of landlords were sub-venting their mortgage from other income, and 71 per cent of landlords were letting below market rent. 25 per cent of landlords had rent [pegged at] 33 per cent below market rent.”

Mr Faughan went on to state that “sadly, 44 per cent of landlords surveyed stated that they intended to leave the market in the next five years.”

Another statistic: “Between 2016 and 2018 over 2000 landlords left the sector and over 12,000 rental homes are no longer available.”